Letter of Administration in Malaysia

- agmohdsabiq

- Sep 7, 2025

- 12 min read

Updated: Sep 18, 2025

1. Introduction

13. Conclusion

1. Introduction

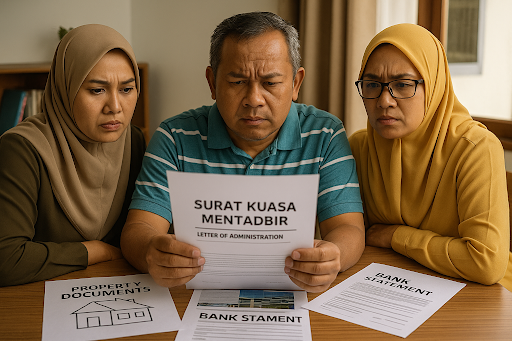

In Malaysia, when someone dies without a will, the process of distributing their estate must follow specific legal procedures. One of the most important steps in this situation is obtaining a letter of administration, known in Malay as surat kuasa mentadbir. This document is issued by the High Court of Malaya and grants authority to an appointed administrator to manage and distribute the deceased’s assets to the rightful beneficiaries.

The letter of administration plays a key role in ensuring that property such as land titles, bank accounts, investments, and other assets are transferred legally. It also safeguards the rights of beneficiaries by ensuring the distribution follows Malaysian succession laws, including the Probate and Administration Act 1959, the Small Estates (Distribution) Act 1955 for qualifying estates, and for Muslims, the application of faraid principles.

This guide explains what a letter of administration is, when it is required, and the step-by-step procedure to apply for one in Malaysia. It will also cover related costs, common mistakes to avoid, and the differences between a letter of administration and probate. Whether you are a potential administrator or beneficiary, understanding this process is essential to protect your legal rights and ensure a smooth estate distribution.

For a better understanding, we’ll be more than happy to assist you. Just click here and we’ll be in touch with you real soon!

2. What is a Letter of Administration in Malaysia?

A letter of administration is a legal document issued by the High Court of Malaya that gives an appointed person — called the administrator — the authority to manage and distribute the estate of someone who has died without leaving a will. In Malaysia, this situation is referred to as intestacy. Without this court order, banks, land offices, and other institutions will not recognise the administrator’s right to deal with the deceased’s assets.

In Malay, the letter of administration is called surat kuasa mentadbir. It serves as formal proof that the administrator has the court’s approval to carry out estate administration tasks, which include collecting assets, settling outstanding debts, and distributing the remaining property to the rightful heirs.

The legal foundation for this process comes mainly from the Probate and Administration Act 1959. Depending on the type and value of assets, other laws may also apply, such as the Small Estates (Distribution) Act 1955 for estates involving immovable property under RM2 million, or Islamic inheritance laws (Faraid) for Muslims.

In short, a letter of administration ensures that estate management in Malaysia follows legal procedures, protects the rights of beneficiaries, and prevents disputes over ownership.

3. When Do You Need a Letter of Administration?

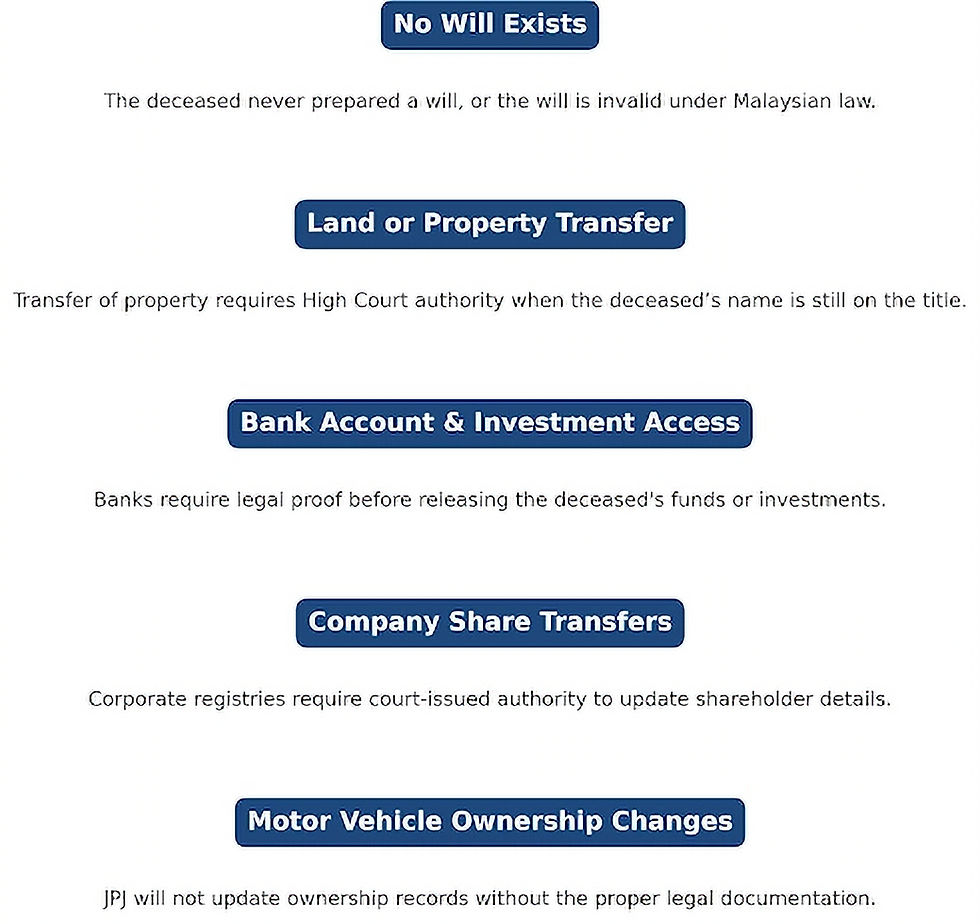

A letter of administration is necessary in Malaysia when a person dies without leaving a valid will — a situation known as intestacy. Without this court-issued document, the deceased’s assets remain legally inaccessible, and financial institutions, land offices, and government agencies will not release or transfer ownership of those assets.

You will typically need a letter of administration in the following situations:

In Malaysia, the need for a letter of administration is determined by asset type, value, and applicable law. For example, small estates involving immovable property valued under RM2 million may be handled through the Small Estates (Distribution) Act 1955, while movable assets under RM600,000 can be managed by Amanah Raya Berhad. However, larger or more complex estates almost always require a High Court application for a letter of administration.

4. Legal Alternatives to a Letter of Administration in Malaysia

Not every estate in Malaysia requires a full High Court application for a letter of administration. In certain situations, there are alternative legal processes that are faster, less costly, and more suitable for smaller or simpler estates. These options depend on the type of assets, their total value, and the applicable laws.

Small Estate Distribution

Under the Small Estates (Distribution) Act 1955, an estate qualifies as a “small estate” if:

It includes immovable property (land or property in Malaysia)

The total value of the estate does not exceed RM2 million

Applications are made to the Land Office where one of the properties is located. The Land Administrator will schedule a hearing, verify the beneficiaries, and issue an order for distribution. This process avoids the High Court entirely, making it quicker and generally less expensive.

Summary Administration by Amanah Raya Berhad (ARB)

If the estate consists only of movable assets (e.g., bank savings, vehicles, investments) worth RM600,000 or less, the administrator can apply to Amanah Raya Berhad. ARB can manage and distribute the estate as if a letter of administration had been granted, but with lower costs and simpler paperwork.

When Alternatives Are Not Suitable

For estates exceeding the above limits, or involving complex asset types (e.g., company shares, multiple properties across states), a High Court application for a letter of administration remains the only valid route.

5. Step-by-Step Letter of Administration Procedure in Malaysia

Applying for a letter of administration in Malaysia is a formal legal process that involves several stages, from identifying the right person to act as administrator to carrying out the distribution of assets. Below is a clear breakdown of each step in the High Court process.

Step 1: Identify a Qualified Administrator

The administrator is usually a legal heir or family member who:

Is at least 18 years old

Is mentally sound

Is capable of performing estate duties. If no family member is suitable, a public trustee can be appointed under the Public Trust Corporation Act 1995.

Step 2: Prepare the Asset, Liability, and Beneficiary List

The administrator must compile:

All assets (land, vehicles, shares, bank accounts)

All liabilities (loans, bills, taxes)

A full beneficiary list according to the Distribution Act 1958 (for non-Muslims) or Faraid (for Muslims)

Step 3: File the Application at the High Court

Submit:

Originating summons and affidavit in support

Death certificate

Identification documents of the administrator and beneficiaries

Proof of relationship

Asset and liability lists

Administration oath

Administration bond and sureties (if required)

Step 4: Attend the Court Hearing

The Registrar or judge will:

Review all documents

Ask questions if clarification is needed

Grant the letter of administration if satisfied

Step 5: Administer the Estate

Once granted, the administrator must:

Collect all assets

Settle debts and taxes

Distribute the balance according to the applicable law

Complete any required registrations, e.g., lodging property transfers at the Land Office

6. Required Documents for High Court Application

Applying for a letter of administration in Malaysia requires careful preparation of supporting documents. Missing or incorrect paperwork is one of the main reasons applications are delayed or rejected by the High Court. Below is a comprehensive list of documents you should prepare before filing.

Document | Description |

Death Certificate of the Deceased | An original or certified copy to prove the death of the deceased. |

Identification Documents | MyKad or Passport of the Administrator and all beneficiaries. |

Proof of Relationship | Birth/Marriage Certificates showing relationship to the deceased. |

List of Assets | Titles, bank account statements, share certificates, and insurance policies. |

List of Liabilities | Loans, outstanding bills, and any other debts. |

Administration Oath | Sworn statement committing to proper estate management and distribution. |

Administration Bond & Sureties (if estate > RM50,000) | Two sureties with assets equal to the estate value, unless waived by the court. |

Managing documentation might be quite tedious, but it is our expertise. We’ll be more than happy to assist you. Just click here and we’ll be in touch with you real soon!

7. Role of the High Court in the Process

The High Court of Malaya plays a central role in the administration of estates when no will exists. It is the only authority that can issue a letter of administration for estates exceeding the limits set under the Small Estates (Distribution) Act 1955 and for matters that involve complex asset types or disputes.

Jurisdiction and Filing Location

Applications must be filed in the High Court that has jurisdiction over the area where the deceased resided or where the assets are located. For immovable property, this is typically the court closest to where the property is registered.

Oversight and Verification

The High Court ensures that:

The applicant is legally entitled to act as administrator.

The list of assets and liabilities is accurate.

All beneficiaries are properly identified.

Sureties are provided where required, unless the court grants a waiver.

Hearing Process

Once the application is filed:

A hearing date is fixed.

The administrator attends court, often represented by a lawyer.

The Registrar or judge may ask questions or request further documents.

If satisfied, the court issues the grant of a letter of administration.

Ensuring Compliance

The High Court’s role is not limited to granting the letter of administration. It also acts as a safeguard against misuse of authority by:

Requiring administrators to account for their actions.

Allowing beneficiaries to raise objections or disputes.

Ordering corrective measures if necessary.

8. Letter of Administration Cost in Malaysia

The cost of applying for a letter of administration in Malaysia can vary significantly depending on the complexity of the estate, the value of the assets, and whether the matter is contested. Understanding these costs upfront helps you plan and avoid surprises.

Main Cost Components

Legal Fees: Engaging a lawyer is highly recommended for a High Court application, as the process involves strict procedural requirements. Legal fees typically start from RM2,000 to RM5,000 for straightforward cases. Complex estates with multiple properties, business assets, or beneficiary disputes can cost substantially more.

Court Filing Fees: These fees are fixed by the court’s schedule of charges and cover the cost of filing your documents. In most cases, they range from RM100 to RM500, depending on the number and type of documents submitted.

Disbursements: These are out-of-pocket expenses incurred by the law firm in handling your matter, such as:

Photocopying and printing

Travel to the court or the Land Office

Stamp duties (if applicable)

Search fees at the Land Office or Companies Commission (SSM)

Surety-Related Costs (if applicable) If your estate requires an administration bond with sureties, you may incur costs for valuation reports or certification of the sureties’ assets.

Factors Affecting Total Cost

Estate size and asset types — Larger, more complex estates require more legal work.

Geographical spread — Properties in multiple states may require additional searches and coordination.

Disputes or objections — Contested matters significantly increase both legal fees and duration.

For smaller estates handled under the Small Estates (Distribution) Act 1955 or via Amanah Raya Berhad, costs are generally lower because the process avoids High Court filing.

9. Common Mistakes and How to Avoid Them

Applying for a letter of administration in Malaysia involves precise legal steps, and even small errors can cause delays, increased costs, or outright rejection of the application. Below are the most frequent mistakes applicants make — and practical ways to avoid them.

1. Incomplete or Incorrect Documentation

Mistake: Missing death certificates, property titles, or relationship proofs; errors in names or IC numbers. How to Avoid: Use a detailed checklist (see Section 6) and have all documents verified by your lawyer before submission.

2. Failing to Obtain Required Authority First

Mistake: Filing for a letter of administration without a proper grant of probate (where applicable) or without satisfying surety requirements. How to Avoid: Confirm legal prerequisites with a lawyer before filing.

3. Misidentifying Beneficiaries

Mistake: Overlooking heirs under the Distribution Act 1958 or Faraid (for Muslims). How to Avoid: Cross-check heirs with applicable inheritance laws and obtain confirmation from all parties before filing.

4. Delayed Filing or Non-Compliance with Court Rules

Mistake: Submitting incomplete forms or failing to follow the Rules of Court 2012. How to Avoid: Engage an experienced probate lawyer familiar with High Court procedures.

5. Not Registering the Court Order with Relevant Authorities

Mistake: Assuming the estate is transferred once the grant is issued. How to Avoid: Register the order with the Land Office, banks, and other institutions promptly.

6. Ignoring Tax and Stamp Duty Obligations

Mistake: Overlooking possible stamp duty on property transfers or estate taxes. How to Avoid: Consult with a property lawyer or tax advisor early in the process.

10. Difference Between Probate and Letter of Administration in Malaysia

In Malaysia, both probate and a letter of administration serve the same ultimate purpose — to give legal authority for managing and distributing a deceased person’s estate. However, they apply to different situations and have distinct legal requirements.

Key Distinctions

Probate is issued when the deceased left a valid will that complies with the Wills Act 1959 (for non-Muslims). The executor named in the will applies to the High Court to validate the will and obtain authority to administer the estate.

Letter of Administration applies when the deceased passed away without a valid will. The High Court appoints an administrator to manage and distribute the estate according to the Distribution Act 1958 for non-Muslims or Faraid principles for Muslims.

Comparison Table

Feature | Probate | Letter of Administration |

When Applicable | Valid will exists | No valid will exists (intestacy) |

Applicant | Executor named in the will | Beneficiary or other qualified person |

Governing Law | Wills Act 1959, Probate and Administration Act 1959 | Probate and Administration Act 1959, Distribution Act 1958, Islamic law (for Muslims) |

Application Process | Submit the will and supporting documents to the High Court | Provide proof of relationship, list of assets/liabilities, sureties (if required) |

Timeframe | Generally faster (if uncontested) | May take longer due to verification and surety process |

Distribution | As stated in the will | According to intestacy laws or Faraid principles |

Sureties Required | Not required | Required if estate > RM50,000 (unless waived by court) |

11. Estate Distribution After Receiving the Grant

Once the High Court issues the letter of administration, the administrator’s role shifts from obtaining authority to actively managing and distributing the estate. This phase is critical, as it ensures the deceased’s assets are lawfully transferred to the rightful beneficiaries in accordance with Malaysian succession laws.

Collecting the Assets

The administrator must first gather all assets listed in the application. This may include:

Withdrawing funds from bank accounts and fixed deposits

Taking possession of property and securing title deeds

Claiming insurance proceeds or EPF savings

Recovering outstanding debts owed to the deceased

Financial institutions and government bodies will now recognise the administrator’s legal authority, provided a certified copy of the grant is shown.

Settling Liabilities

Before distribution, the administrator must pay:

Funeral expenses (reasonable and necessary)

Outstanding loans or mortgages

Utility bills, property taxes, and other debts. Failure to clear liabilities can lead to legal claims against the estate.

Distributing the Estate

Distribution must follow the applicable law:

For non-Muslims: As per the Distribution Act 1958, with shares allocated to spouse, children, and parents as defined by law.

For Muslims: Based on Faraid principles, which allocate fixed shares to heirs under Islamic law.

All transfers of immovable property must be registered with the Land Office, while share transfers must be recorded with the Companies Commission of Malaysia (SSM) or the relevant share registrar.

Closing the Administration

Once all assets are distributed and debts are cleared, the administrator’s duties are complete. In some cases, a final account of administration may be required to be filed with the court or shared with beneficiaries for transparency.

12. Frequently Asked Questions (FAQ)

1. What is a letter of administration in Malaysia? It is a court-issued document authorising an appointed administrator to manage and distribute the estate of a deceased person who died without a valid will (intestacy).

2. How long does it take to get a letter of administration? If uncontested and with complete documents, the process typically takes 6–9 months. Delays can occur if documents are incomplete, disputes arise, or the court requests further clarification.

3. Who can apply for a letter of administration? Usually, a spouse, child, or close family member who is at least 18 years old and mentally sound. In some cases, a public trustee or professional administrator may be appointed.

4. How much does it cost to obtain a letter of administration in Malaysia? Legal fees for straightforward cases start from RM2,000 to RM5,000, plus court filing fees and disbursements. Complex or contested estates may cost more.

5. What is the difference between probate and a letter of administration? Probate applies when there is a valid will and the executor applies to the court for authority. A letter of administration applies when no valid will exists, and the court appoints an administrator.

6. Are sureties always required? Yes, if the estate’s value exceeds RM50,000, unless the court grants a waiver.

7. Can foreigners apply for a letter of administration in Malaysia? Yes, but they must meet eligibility requirements and may face additional administrative steps if they reside overseas.

13. Conclusion

The letter of administration process in Malaysia is a crucial legal step for managing and distributing the estate of someone who has passed away without a will. Whether it involves real estate, bank accounts, company shares, or other assets, this court-issued authority ensures the estate is handled in line with Malaysian laws such as the Probate and Administration Act 1959, the Distribution Act 1958 for non-Muslims, or Faraid principles for Muslims.

By understanding when a letter of administration is required, the available legal alternatives, and the step-by-step High Court procedure, you can avoid delays, disputes, and unnecessary expenses. Preparation is key — gathering complete documents, identifying all beneficiaries, and complying with court requirements will make the process smoother.

While it is possible to navigate the process without professional help, having an experienced probate lawyer can significantly reduce the risk of mistakes and speed up your application. For administrators and beneficiaries alike, getting the process right protects your legal rights, ensures fair distribution, and honours the wishes of the law.

If you need guidance or legal representation in obtaining a letter of administration in Malaysia, our team is ready to assist you from application to final distribution. Just click here and we’ll be in touch with you real soon!

Comments